Design for Trust is the foundation of fintech and B2B platforms, where user confidence directly impacts adoption and growth. The global Fintech industry is exploding with user interface design opportunities, valued at $226.71 billion in 2024 and projected to reach a staggering $1071.27 billion by 2034, growing at 16.8% CAGR. Despite this massive growth, nearly half of all consumers (47%) still worry about data security when using fintech apps.

When designing for fintech and B2B platforms, we’ve found that trust isn’t just a nice-to-have feature—it’s absolutely essential. The principles of user interface design must prioritize security and transparency, especially as fintech startups have more than doubled from 12,000 in 2019 to over 26,000 globally. Every day, these services handle vast amounts of personal and financial information, yet ensuring people share this data online remains one of the biggest challenges for fintech products.

In our experience with user experience and interface design, incorporating multi-factor authentication, clear data permission protocols, and transparent pricing can significantly boost user confidence. As we explore the app user interface design process in this article, we’ll reveal how thoughtful design choices can transform skeptical visitors into loyal customers. After all, trust is a commodity that’s challenging to earn and even harder to maintain, especially when dealing with people’s hard-earned money.

Understand Why Design for Trust in Fintech and B2B Matters?

“People never choose a new financial service impulsively. Customers study every option, check security features and seek trusted advice before making a decision.”

Dmitry Shishkin, Fintech Content Strategist

Trust serves as the foundation of any financial relationship, particularly in digital environments where physical reassurance is absent. Understanding why users hesitate to trust financial platforms and the resulting costs is crucial for effective user interface design.

Why users hesitate to trust financial platforms?

Fintech platforms face inherent skepticism from potential users due to several key factors. Security concerns rank among the top reasons for hesitation, with many consumers reluctant to perform online transactions because they lack trust in online financial companies. This hesitation isn’t unfounded, as high-profile incidents have damaged consumer confidence in the past.

For example, in 2016, Lending Club (a prominent peer-to-peer lending platform) faced a significant scandal when executives sold INR 1856.37 million in loans to investors despite knowing those transactions didn’t meet buyers’ criteria. Consequently, the company’s founder and CEO were forced out, and shares plummeted by 35%. Such incidents create lasting impressions that affect the entire fintech sector.

Research shows that perceived legal risks, security vulnerabilities, and privacy concerns act as significant inhibitors of fintech adoption. Users conduct mental risk-benefit analyzes before engaging with financial platforms, and will only proceed when benefits clearly outweigh potential risks. This explains why principles of user interface design must prioritize visually communicating security at every touchpoint.

Furthermore, the rise of social media has introduced new trust challenges. Studies reveal that misuse of social media in B2B marketing practices significantly influences the climate of distrust within business environments. This distrust is amplified when antagonism is present, creating conspiracy beliefs that further erode confidence.

The cost of low trust in Fintech and B2B apps

The financial implications of poor user interface design that fails to establish trust are substantial. Companies investing in customer acquisition face serious challenges if they cannot retain those customers long-term. As one study notes, “If Fintech companies cannot retain customers and facilitate continuous use, they will not recover these costs and achieve long-term success”.

For B2B platforms specifically, the stakes are extraordinarily high. Business buyers now make substantial purchases online, with approximately 70% of decision-makers willing to spend up to USINR 42190225.40 in a single online transaction. Moreover, a growing number report comfort with spending up to USINR 843.80 million. These figures represent massive revenue opportunities that can be lost without proper trust signals in the user experience and interface design.

The absence of trust also creates operational inefficiencies:

- Higher transaction costs: When buyers and sellers lack mutual trust, more verification steps and checks are required, increasing the cost of doing business

- Reduced information sharing: Trust encourages buyers and sellers to share information, resources, and expertise more freely

- Complicated conflict resolution: Without trust as a foundation, resolving disputes becomes more difficult and often requires marketplace intervention

Research confirms that trust serves as a mediator that can dampen the negative effects of perceived risks on fintech adoption. Indeed, studies indicate that “customer trust in fintech” outweighs other factors in determining technology adoption. Consequently, user interface design process must prioritize building trust through thoughtful design choices that address these concerns directly.

Design for Security and Compliance

Security features in fintech and B2B platforms form the cornerstone of user trust. Effective security design not only protects users but visually communicates safety through thoughtful user interface design principles.

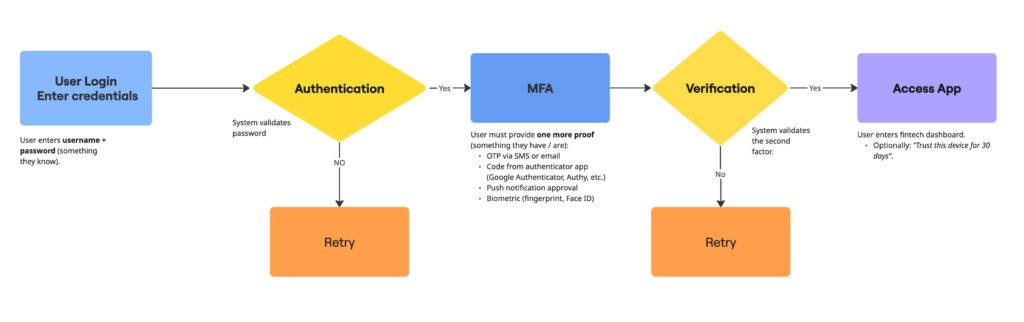

Use of multi-factor authentication

Multi-Factor Authentication (MFA) dramatically strengthens security by requiring users to provide multiple verification factors before accessing financial platforms. Essentially, MFA combines:

- Something you know (password or PIN)

- Something you have (mobile device or security token)

- Something you are (biometric data like fingerprints)

This layered approach makes unauthorized access significantly more difficult, even if one factor is compromised. Research shows that implementing MFA has reduced unauthorized access by 40% in online banking. Primarily, MFA serves as a critical first line of defense in B2B integrations, ensuring that only verified users can access sensitive financial data.

Explain compliance standards in simple terms

Compliance with regulations builds user confidence, whereas complex jargon creates confusion. Effective user interface design process involves translating complex standards into understandable terms. For instance, explaining that GDPR gives users rights to access, correct, and delete their data makes the regulation relatable.

Financial platforms must address key frameworks like SOC 2 (focusing on data security across five principles) and HIPAA (protecting health information). Organizations failing to comply with regulations like GDPR face penalties up to €20 million or 4% of annual revenue. In practice, design should highlight these compliance efforts through clear privacy policies and permission screens.

Implement automatic logouts and session timeouts

Automatic session timeouts represent a crucial security measure in financial applications. This feature logs out inactive users after a predetermined period, thereby protecting sensitive information on shared or unattended devices. Session timeouts are particularly valuable in preventing unauthorized access if a user forgets to manually log out.

In financial apps, implementation typically involves timing user inactivity and redirecting to the login screen after the designated period elapses. The user interface design should make this security feature intuitive by providing countdown notifications and clear explanations of why the feature exists.

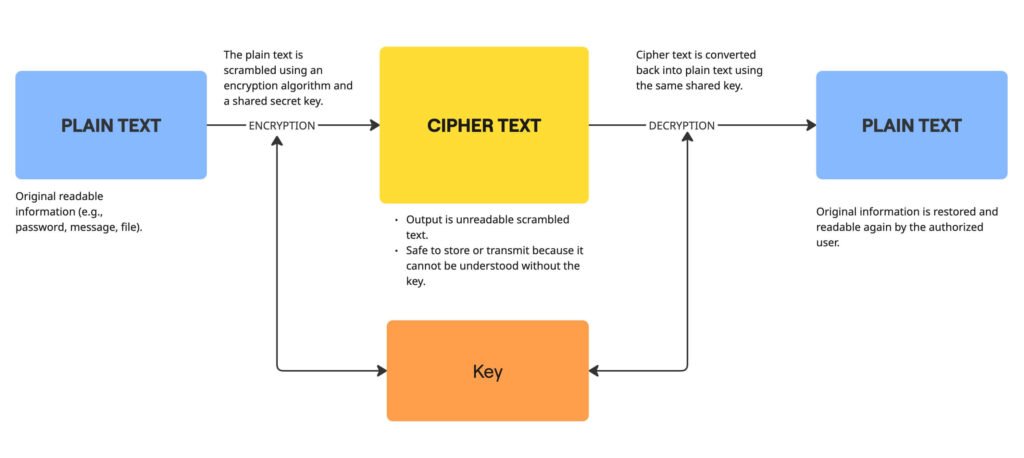

Highlight encryption and data protection protocols

Strong encryption protocols form the backbone of data protection in fintech platforms. Transparently communicating these safeguards through the interface builds user confidence. Key protocols include TLS (Transport Layer Security) for protecting data in transit and AES (Advanced Encryption Standard) for data at rest.

Additionally, financial platforms should integrate visual indicators of encryption status and data protection measures. Coupled with regular security auditing and continuous monitoring of data exchanges, these measures help identify potential threats. The user interface should clearly highlight these protection measures through security badges, encryption indicators, and simplified explanations of technical safeguards.

Be Transparent with Data and Pricing

“Design can help create transparency and trust by showing users exactly what is happening with their personal information.”

Merge Rocks Editorial Team, Fintech Product Design Agency

Transparency forms the third pillar of trust in fintech and B2B platforms, complementing security and reliability. In my experience implementing user interface design principles for financial applications, I’ve found that openness about data practices and costs directly correlates with user confidence.

Clarify data collection and usage policies

Clear data collection policies are fundamental to user interface design process. Studies show that when users discover unexpected data usage, they feel manipulated, leading to dissatisfaction and eroding consumer trust. Accordingly, I recommend creating straightforward privacy interfaces that explain:

- What personal information is being collected

- How this information will be used

- Which third parties might access the data

- How long data will be retained

Given that many fintech platforms operate in co-branded partnerships where both entities could be perceived as data fiduciaries, it’s crucial to establish clear boundaries of responsibility in your interface design. Meanwhile, the FTC has issued guidelines addressing transparency that give consumers access to what has been collected and educate them about privacy practices.

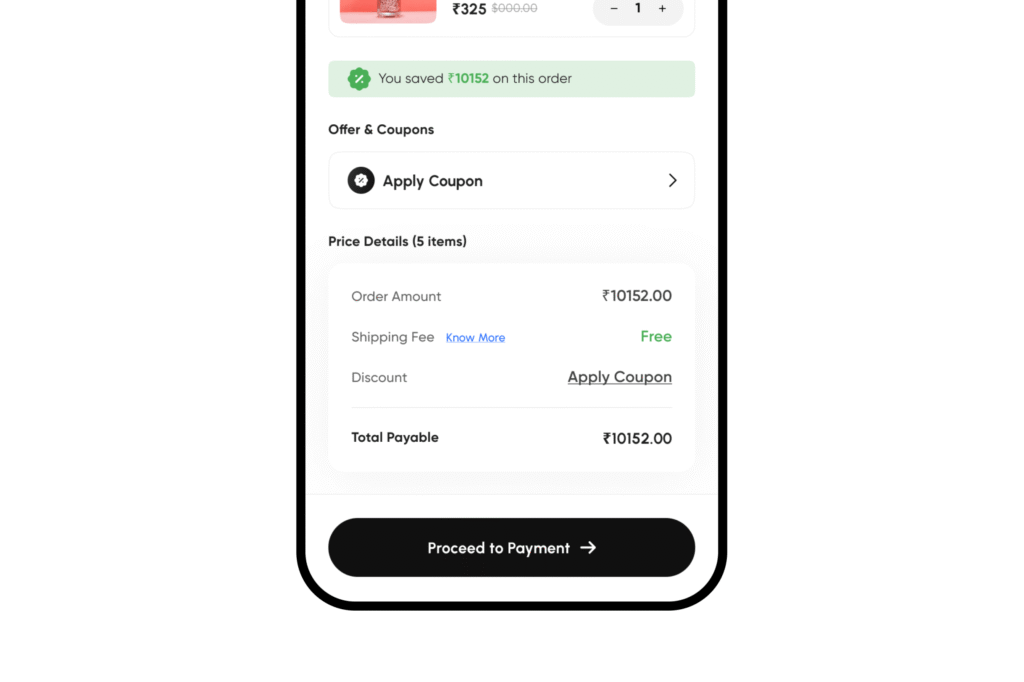

Disclose all fees and charges upfront

Fee transparency isn’t merely a buzzword it’s the lifeline of businesses in the competitive financial world. In fact, 94% of customers prefer brands that demonstrate sincerity and transparency. Hiding costs has serious consequences; Americans spend approximately INR 1122.26 billion on fintech subscription fees, making fee disclosure paramount.

Throughout the user experience and interface design, I’ve found these approaches effective:

- Standardize pricing displays showing product base price, shipping charges, taxes, and additional expenses

- Implement tooltips explaining each fee component

- Provide interactive calculators showing total costs under different scenarios

Transparent pricing reduces confusion and enhances budgeting efficiency—trade buyers can assess costs more effectively and adjust their budget forecasts accordingly.

Explain algorithmic decisions clearly

The rise of algorithmic decision-making introduces unique transparency challenges. Many customers remain unaware of how underwriting algorithms work or what data inputs influence decisions. My app user interface design best practices include:

Firstly, explaining the logic behind credit decisions in simple language. Out of 30 digital borrowers surveyed in Rwanda, 16 were rejected for digital loans, yet only 10 recalled receiving explanations—and six of those found the explanations inadequate.

Subsequently, creating visual interfaces showing which factors most influenced decisions while maintaining system security. This approach acknowledges that fair access, clear disclosures, and explainable decisions are central to compliance in financial services.

Ultimately, algorithms that make unexplained decisions risk eroding consumer trust and damaging institutional reputations.

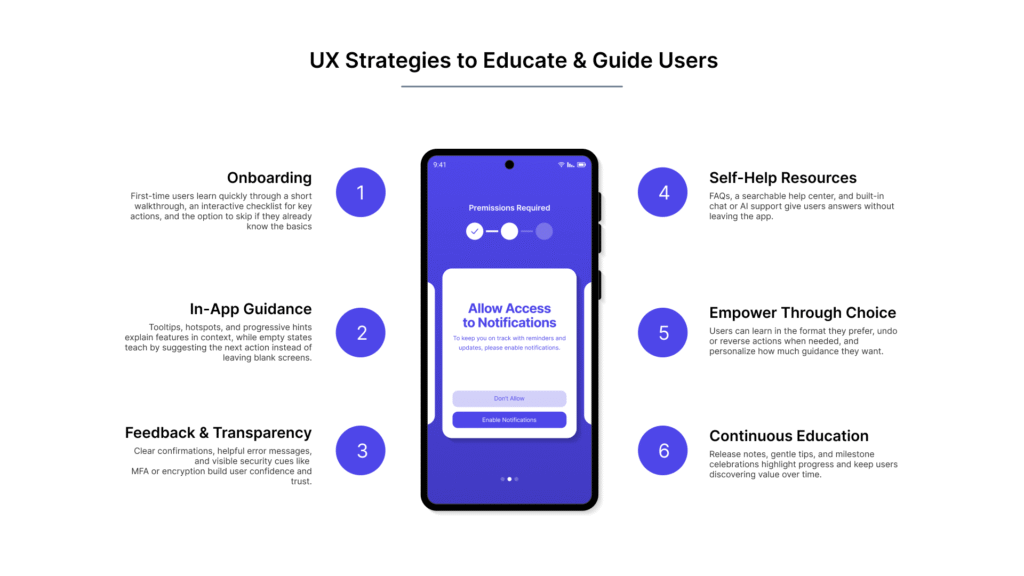

Educate Users Through UX

Educational elements within your user interface design serve as powerful trust builders in fintech and B2B applications. By helping users understand complex financial concepts, you create confident customers who trust your platform enough to conduct transactions.

Use in-app tutorials and tooltips

In-app content can transform text-heavy financial tutorials into digestible pieces that users actually engage with. Interactive elements like quizzes help maintain user attention while reinforcing learning. These tutorials can be strategically placed at critical customer journey touchpoints, making onboarding smoother and more intuitive.

Through user experience and interface design that incorporates in-app messaging, platforms have reported stable growth and increased session times. Initially focusing on explaining key product values through engaging full-screen formats helps users grasp essential concepts without feeling overwhelmed.

Offer demo videos and FAQs

Effective B2B demo videos prioritize subtlety over direct promotion. Rather than bombarding viewers with feature lists, successful demos use clean, animated visuals to communicate platform capabilities. For instance, RingCentral’s approach elegantly suggests workflow revolution through smooth transitions between communication modes, implying ease of use without explicitly stating it.

Similarly, Morning Consult’s video tackles business challenges by visualizing market complexities, presenting their solution as an essential compass in the data storm. Hence, your user interface design process should include video content that transforms abstract concepts into tangible assets.

Simplify financial concepts with visuals

Animation significantly enhances understanding of complex financial instruments—by approximately 55% compared to traditional text explanations. Visual storytelling influences viewer emotions, affecting how financial institutions are perceived. In fact, customers who viewed animated explanations rated their trust in financial advisors 40% higher than those who received identical information in text form.

Provide real-time alerts and notifications

Real-time notifications keep users informed about account activities, thus reducing the risk of fraud while improving operational efficiency. Across industries, 56% of fintech apps report increased engagement after implementing push notifications. Transactional alerts have reduced fraud by nearly 20% in major apps simply by notifying users of suspicious activity.

Personalized notifications allow customers to choose their preferred alerts, delivery modes, and timing. As a result, one banking app saw a 25% jump in daily active users after implementing real-time updates.

Showcase Trust Signals and Social Proof

Visual trust signals serve as powerful psychological anchors in fintech and B2B user interface design. These elements create immediate reassurance for users handling sensitive financial information.

Display certifications and security badges

Visual security cues like lock icons, SSL certificates, and verification badges effectively communicate safety throughout the user interface design process. These symbols leverage established trust patterns that users instinctively recognize. Security in fintech cannot remain invisible—users need to see and understand the protection measures implemented.

Use customer testimonials and reviews

Customer testimonials provide essential credibility in B2B platforms, with 88% of decision-makers citing recommendations as crucial drivers during their research phase. Moreover, vendors who incorporate customer reviews into their content experience conversion rate increases averaging 30%. Video testimonials prove particularly effective, as 83% of video marketers report they help generate sales leads.

Highlight app downloads and user base

Displaying your total user count or download figures creates immediate social validation. This approach reassures potential users they’re not alone in trusting your platform.

Maintain a polished and professional UI

The words you select directly impact user trust. Jargon and legal terminology create barriers, whereas clear, conversational copy makes complex financial concepts accessible. A professional yet approachable user experience and interface design demonstrates competence while remaining welcoming.

Conclusion

Building trust remains fundamental to successful fintech and B2B platform design. Throughout this article, we’ve explored how thoughtful design choices can transform skeptical visitors into loyal customers. Security features like multi-factor authentication, automatic logouts, and visible encryption protocols serve as the first line of defense against potential threats while simultaneously reassuring users of their data safety.

Transparency stands equally important. Users expect clear explanations about data collection practices and straightforward pricing structures without hidden fees. This honesty creates a foundation for lasting relationships between financial platforms and their customers. Additionally, educational elements within your interface empower users to make informed decisions, whether through interactive tutorials, simplified visuals, or real-time notifications.

Trust signals further strengthen this relationship. Certifications, customer testimonials, and user statistics provide social proof that your platform deserves confidence. Professional design elements and clear, jargon-free language complete the trust-building process by demonstrating competence and accessibility.

Remember that trust functions as a precious commodity in the financial world – difficult to earn yet remarkably easy to lose. Financial decisions rarely happen impulsively. Instead, customers carefully evaluate security features and seek trusted advice before committing. Therefore, every design element must contribute to an overall sense of reliability and trustworthiness.

The principles outlined here do more than just improve esthetic appeal – they directly impact user confidence, platform adoption, and ultimately, business success. After all, financial platforms handling people’s hard-earned money must prioritize security, transparency, education, and professionalism at every touchpoint. When we design with trust as our guiding principle, both businesses and users benefit from stronger, more confident relationships.

Key Takeaways

Trust is the cornerstone of successful fintech and B2B platform design, directly impacting user adoption and business success in an industry where customers carefully evaluate every security feature before making financial decisions.

• Implement robust security features: Use multi-factor authentication, automatic logouts, and visible encryption protocols to create immediate user confidence and reduce unauthorized access by up to 40%.

• Prioritize complete transparency: Disclose all fees upfront and explain data collection practices clearly, as 94% of customers prefer brands demonstrating transparency over hidden costs.

• Educate users through intuitive design: Use in-app tutorials, visual explanations, and real-time notifications to simplify complex financial concepts and increase user engagement by 25%.

• Display trust signals prominently: Showcase security badges, customer testimonials, and user statistics to provide social proof, as 88% of B2B decision-makers rely on recommendations during research.

• Maintain professional UI standards: Use clear, jargon-free language and polished design elements to demonstrate competence while remaining accessible to users handling sensitive financial data.

When financial platforms prioritize trust-building through thoughtful design choices, they transform skeptical visitors into loyal customers who feel confident sharing their financial information and conducting transactions online.

FAQs

Q1. What are the essential elements for building trust in fintech and B2B platforms?

Key elements include robust security features like multi-factor authentication, transparent data and pricing policies, educational UX components, and prominent trust signals such as security badges and customer testimonials.

Q2. How can fintech apps effectively communicate security measures to users?

Fintech apps can communicate security through visual cues like lock icons and SSL certificates, clear explanations of encryption protocols, and by implementing and highlighting features such as automatic logouts and real-time alerts for suspicious activity.

Q3. Why is transparency important in fintech and B2B platforms?

Transparency builds user confidence by clarifying data collection practices, disclosing all fees upfront, and explaining algorithmic decisions. This openness reduces user skepticism and fosters long-term trust in the platform.

Q4. What role does user education play in fintech app design?

User education is crucial in fintech design. It empowers users to make informed decisions through in-app tutorials, demo videos, simplified visual explanations of complex financial concepts, and real-time notifications, ultimately increasing engagement and trust.

Q5. How can fintech platforms leverage social proof to build trust?

Fintech platforms can build trust through social proof by displaying customer testimonials, showcasing app download numbers and user base statistics, and maintaining a professional UI with clear, jargon-free language that demonstrates competence and reliability.